Coming into land in 2024

For most of the past two years, investors in all asset classes, certainly not just equities, have been wondering what sort of landing we would experience. In my opinion, the jet plane analogy is a very apt way of thinking about the state of the global economy.

Sunday, December 31st 2023, 4:03PM

by Castle Point Funds Management

By Stephen Bennie

It’s quite a straightforward parallel. When a jet plane takes off, that is when an economy is moving into recovery mode, a return to growth after a recession, so all good. Then when the jet plane is at its 35,000 feet cruising altitude, the economy can be viewed as ticking along nicely and only having to deal with the occasional spot of turbulence. This was pretty much the state of the global economy for most of the past decade following the successful take off post the Global Financial Crisis of 2008. So really nothing more alarming than the occasional “please fasten seat belts, we might have some turbulence ahead” warning for the passengers in the jet plane to deal with.

However, in late 2021 when the US Federal reserve conceded that inflation was not transitory and interest rates were going to have to go up and soon, it was a dramatic change in circumstance. Effectively that was like the captain of the jet plane going onto the overhead speaker and announcing that, “An engine is overheating, please fasten seat belts, and use the oxygen masks that have just dropped down in front of you. We need to make a rapid descent”. And just like that it’s chaos in the cabin for passengers in business, premium economy, cuddle class and the back of the bus. Everyone is abruptly having to process the possibility of a life-threatening emergency landing.

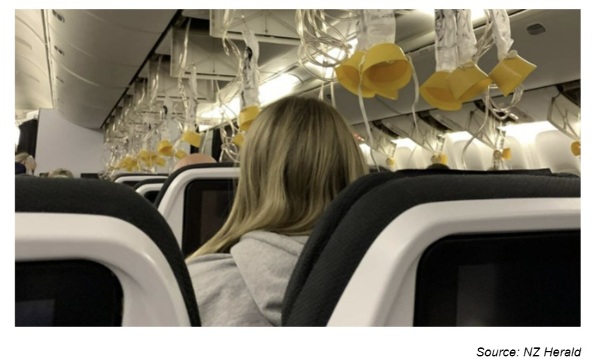

A sight passengers never want to see on a jet plane

The analogy here is very similar to one which occurred on an Air New Zealand flight last year from Los Angeles to Auckland. The photo above was taken by a passenger on that August 2022 flight. Apparently with around four hours of the flight left and the plane in night mode, all hell suddenly broke loose. According to a passenger interviewed by the NZ Herald, in the middle of the night the lights blinked on. Oxygen masks fell from overhead and the loudspeaker began blaring, “This is an emergency. This is an emergency. Put on your mask”. That passenger reported that she saw at least two people having panic attacks with one sadly collapsing in the aisle leading to requests for a doctor. Fortunately though, within minutes the passengers were advised that the situation was under control and that the emergency had been a false alarm¹.

Without doubt even a false alarm like that is bad enough. But even worse is the reality of having to descend because of an engine overheating with the real possibility of emergency landing is the stuff of absolute nightmares. That though is exactly where the global economy looked like it might be heading once inflation ran out of control. Altitude had to be lost quickly to try and stop the overheating. The volatile markets of 2022 clearly correlate to this urgent need to get inflation under control. In the case of the global economy it was all about raising interest rates to cool inflation.

So now it’s up to the pilot to try and make a safe landing. You’ll doubtless have heard lots of talk of soft and hard landings over the past year or so. Managing to get inflation down and avoid a deep recession is a soft landing where the plane manages to land and taxis to a gate without incident. The hard landing is where the economy falls into a deep recession, here the landing gear just will not deploy, and the fire engines have been scrambled to wait for you on the runway. At this point any passengers still conscious are taking a very deep breath and gripping their arm rests hard.

2024 is shaping up as the year where we find out what sort of landing our jet plane is going to have. I think the positive development is that this year the economic readings of lower inflation and reasonably robust consumer demand has opened up the scenario that the jet engines may have cooled enough that the economy may not be required to land at all². In essence a recession has been avoided if no landing is required. That would be a great outcome for the global economy and open up the potential for strong share markets in 2024.

¹ Panic on Air NZ flight as masks drop, false emergency declared - NZ Herald

² Recession avoided, inflation down as economy defies dark expectations - The Washington Post

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

Stock photos can be found here:

https://castlepoint.sharepoint.com/:f:/s/Consultant/EsyXv-TcMlpDn8nDLVXk8tsBWBOMAeERgXPKwmjt8aVzeA?e=BJbuYg

More information can be found at:

Castle Point is the issuer of the Ranger, 5 Oceans and Trans-Tasman Funds. Our Product Disclosure Statement can be found here: Castle Point Funds | PDS

| « Three risks we are thinking about for 2024 | The bird in the hand or two in the bush? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |