Time to revisit banking in New Zealand?

“The only thing worse than a very profitable banking system is a very unprofitable banking system.” Jonathan Mott, 2010, from his presentation to the Australian Senate Economic References Committee inquiry into Competition within the Australian banking sector

Monday, February 12th 2024, 6:54AM

by Harbour Asset Management

By Andrew Bascand, Managing Director, Portfolio Manager

Last year, after having blocked the National Party’s call for an enquiry into bank competition, the Labour Government issued the terms of reference for a Commerce Commission Study into personal banking services. That study will examine whether there is sufficient competition to promote innovation and better outcomes for consumers.

A draft report is due in March this year before a final report in August. Perhaps readers may assume the concentrated nature of the market creates market power leading to consistently high profits. After all, the four large banks (ANZ, ASB, BNZ and Westpac) make up about 85% of the lending market and a larger share of the bank deposit market. Many pundits remark on the high dollar value of profits stemming from the banks. For investors in the share market-listed banks, however, it is the return on invested capital, earnings per share and dividends per share that are more useful markers of profitability. And, on those counts, the idea that banks are over-earning relative to capital employed is not an obvious conclusion to reach.

The profitability picture is clouded by regulatory decisions on how much capital systemically important banks need to hold to both protect their prudential requirements and those of the broader financial system. The recent Reserve Bank of New Zealand Capital Review was a 5-year process which examined capital adequacy rules for New Zealand banks. The release of that review in 2019 set in train an implementation timetable that currently runs through to 2028. A similar Reserve Bank of Australia review changed the recognition of capital held in subsidiaries, such as the New Zealand banks, having the effect of further increasing capital requirements. While all these moves have clearly increased the resilience of the banking system here and in Australia, submissions highlighted there is no such thing as a free lunch. As Australian Senator Brandis noted in 2010, “in the tension between stability and competitiveness, we sacrifice stability for every incremental gain in competitiveness. The more competitive the system is, the more the banks will also factor in a greater premium for risk.” At the end of the day, capital needs to strike a fair rate of return across different sectors, and a fair rate of return for risk.

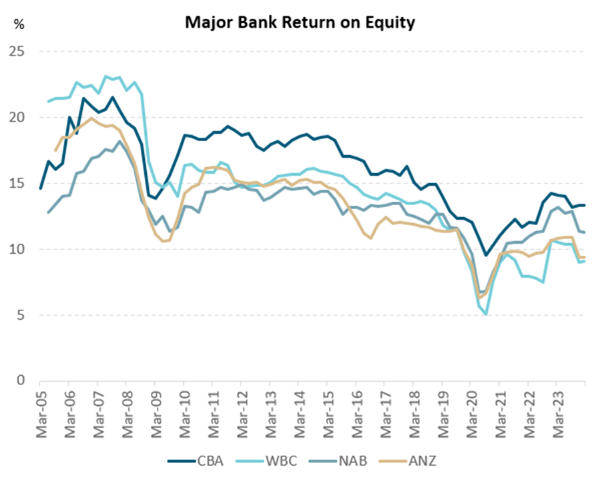

In the 20 years before the GFC (global financial crisis), Australian major bank return on equity averaged around 16%, about the same as the average stock on the Australian stock exchange. Bank returns have fallen since, with the current year return on equity for the major banks being between 9.4% and 13.3% for the 2023 year. At the same time, the average return on equity across more than 250 stocks listed in Australia and New Zealand today is also 13.0%. These numbers suggest that banks are not over-earning relative to capital employed.

Source: Bloomberg, Harbour Asset Management

You could be forgiven for thinking that the equity market believes the banking sector may be about to ramp up profits. Bank share prices have been on a tear since the recent sharemarket bottom on 30 October 2023. For instance, CBA, WBC, NAB and ANZ’s share prices are up 19.9%, 22.2%, 20.3% and 15.4% respectively in that short space of time.

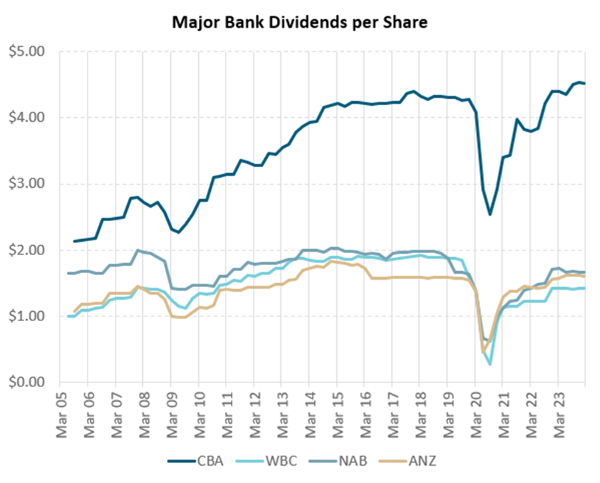

Perhaps more interesting though is that, over that same short timeframe, expectations of bank earnings over the next 12 months have only meaningfully improved for CBA (ASB’s owner). The fact is that, since 2007, earnings per share for three of the four big banks have barely moved. Only CBA has seen a sustained improvement in earnings per share. And it’s a similar story for dividends per share.

Source: Bloomberg, Harbour Asset Management

When you consider this background of weaker profitability, some Australian-based bank analysts have recently reintroduced the idea that the banks should consider further strategic moves to lift profitability relative to capital employed.

It wasn’t that long ago that Westpac issued a curious stock exchange announcement. In March 2021 Westpac considered “whether a demerger (of its New Zealand subsidiary) would be in the best interests of shareholders”. After what seemed to be a very short period of consideration, on 24 June the same year Westpac announced a total commitment to retaining 100% ownership and “will not proceed with a demerger of the Westpac New Zealand business.”

Could a strategic review (and not just from Westpac) again come onto the boardroom tables – and if so, why?

In part, it’s a reflection of a likely change ahead in the leadership of the Australian banks. Current Australian bank CEOs have been in their roles between about 4-8 years, with a typical rotation in those roles of about 6-8 years. In the last week investors were likely surprised with Ross McEwan’s announced date for a step down from his four years at the helm of NAB. While a change at the top doesn’t always mean a wholesale change in strategy, and in the case of NAB, investors know Andrew Irvine who is well tenured at NAB as part of their senior leadership team. However, there are other new pressures to consider too. For instance, the RBNZ is soon to outline the nature of a levy to fund the Depositor Compensation Scheme, most probably setting out a framework in April 2024. While banks may attempt to recover these levy costs through lower deposit rates, it is also possible that the levy may see some erosion in bank net interest margins.

Tax is another key factor in considering full- or part-Australian ownership of New Zealand bank subsidiaries, given the difficulty in streaming tax-paid imputation credits to the group level to sustain dividend growth. Australian banks can no longer thinly capitalise their New Zealand subsidiaries and, as a result, the banks generate surplus New Zealand imputation credits which could be better utilised by a New Zealand shareholder base. And, in perhaps a lesser-known arcane policy change, the RBNZ now requires effective operational separation, largely eliminating many of synergies from back-office processing capabilities between the Australian parent bank and the local entity. This also makes any potential separation process easier.

There may well be demand from investors to invest directly in a major New Zealand-domiciled bank. However, a key requirement would be whether the return on equity opportunity can at least match, if not better, other investment opportunities.

Andrew Bascand is managing director at Harbour Asset Management Ltd. This content is not intended as financial advice. Harbour Asset Management is the investment manager for portfolios that invest into companies mentioned in this article.

Important disclaimer information

| « The bulls are back | Mint spearheads letter to the Government addressing Modern Slavery Legislation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |