Wrestling the gorilla

Despite incessant commentary to the contrary, the US economy is the strongest it has been in over 30 years

Wednesday, March 20th 2024, 6:20AM

by Insync

By Grant Pearson

We have said many times why trying to predict economic outcomes in an upcoming year is fraught with danger.

We even charted a few famous commentators and forecasts versus actual outcomes. Simply, no matter how famous or big the institution, or how clever the person, they are wrong far more than right.

Given that these macro forward views shape how most fund managers invest and make decisions, it’s a worthwhile exercise for advisers to track the managers they use against how successful and aligned to their own commentary they really are.

For the record, we are not in the game of forecasting macro settings, as we see little value in it once ego is placed to one side. It’s very important with this in mind to note that factually, when everything seems bleakest it is uncannily common for it to be at its brightest.

Let’s look at the economic gorilla of the world – the USA. At the end of 2022 and early 2023, most managers, economists and commentators warned that bad times lay ahead. Here are 8 key indicators that show that for last year and indeed for at least 30 years, the US has never been in better shape.

1.Wage growth: Despite all the worry and bleak predictions and what has become accepted as bad times, the reverse is true. Wages experienced 5% growth.

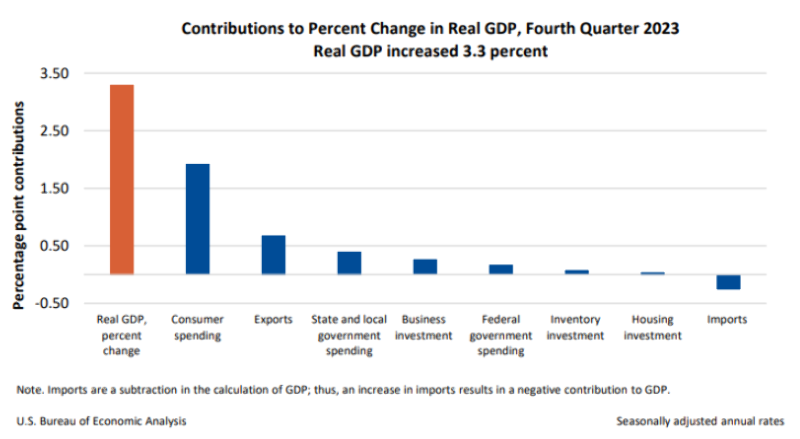

2.GDP: 3.3% Real growth with an annualised run rate of 4.9%.

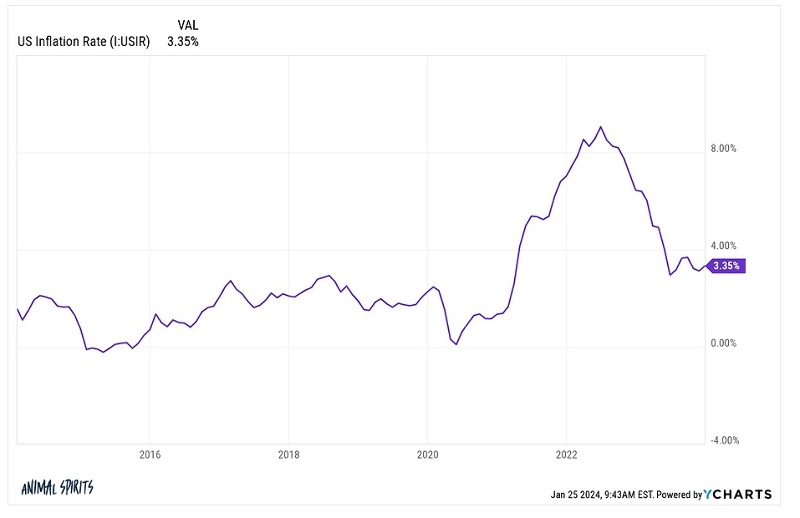

3.Inflation: This stands at just over 3% nominal. So we’re talking 2% real wage growth and 6% nominal economic growth. Several commentators last year worried about a 1970s style stagflation. Remember that? The simple fact is that today’s situation looks more like the 1990s economy than the 1970s.

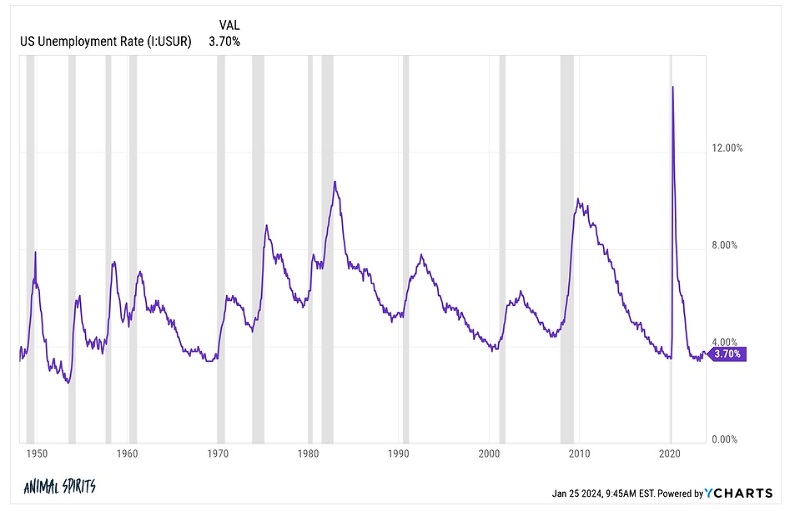

4.Unemployment: This remains stubbornly low, after Covid and government free money distributions. In the 1990s, it averaged 6% and was never as low as 4%. The super-driver of Demographics is playing its part in this.

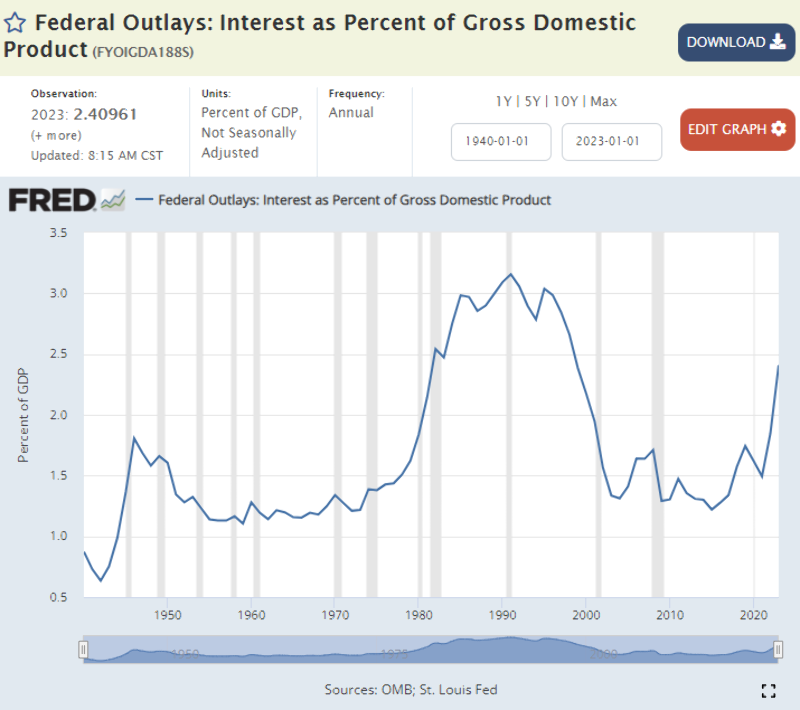

5.Government debt: Ahh, some wag the finger that it’s all debt fueled, but let’s see.

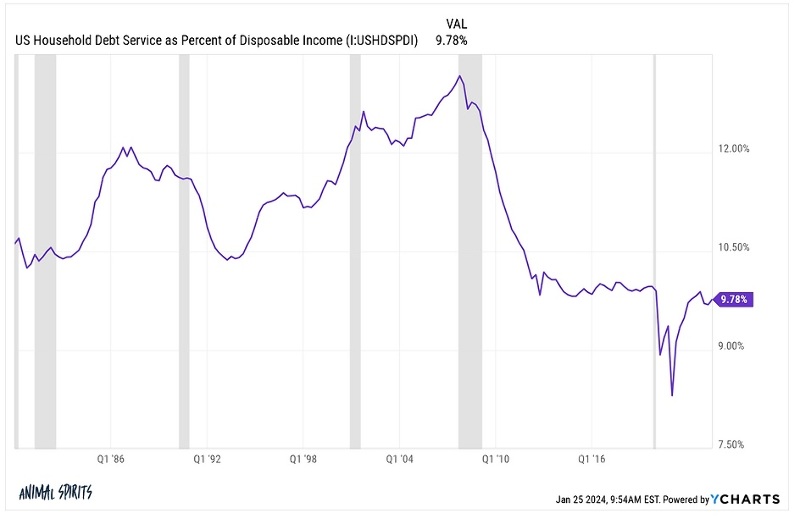

6.Household debt: Whilst looking at debt, let’s look at US families and their ability to service their debts and higher rates closer to longer term averages than the last 10 years. It is far, far better than in the 1990s.

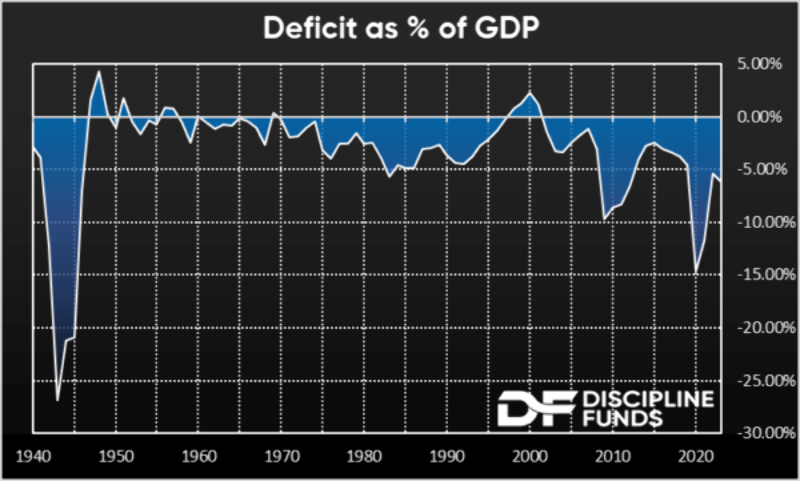

7.The federal deficit: Surely this is bad? Let’s see.

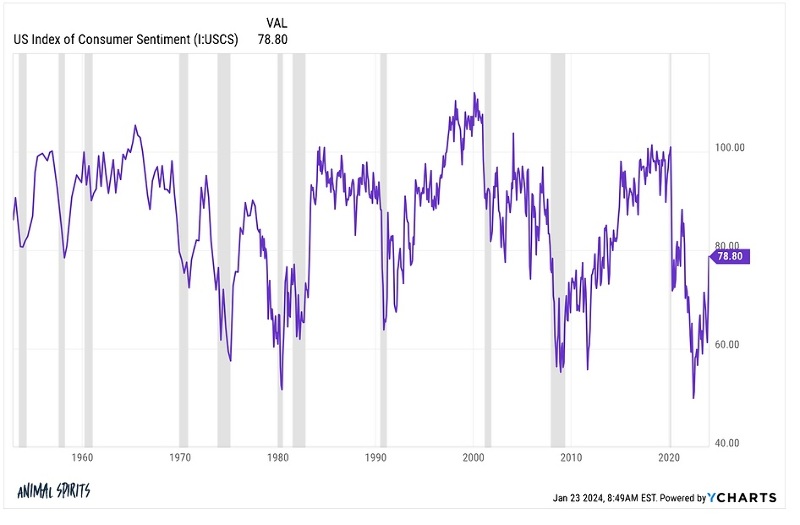

8.What is worse is sentiment: It was last this bad way back in the early 1970s during the great financial crisis, although it has recently bounced back. Unedited, unreviewed, non-expert information, thanks to the social media boom, has likely influenced this – something we didn’t have in the 1990s.

Will the good times end?

Perhaps it’s best said by that infamous barman from the 1980s movie ‘Cocktail’...

“Everything ends badly otherwise it wouldn’t end.”

The unknown but most essential question is of course when?

For those in cash, and there has been a lot sitting on the sidelines for years now, bad times would have to be catastrophic, with an ending of biblical proportions. Not only that, but those in cash would also have to make immediate constant gains and have that continue for years afterwards, just to keep alongside in dollar value terms those who remained invested in productive business assets all these years.

The odds of a biblical sized catastrophe and timing it close enough to exit, then re-enter at the gloomiest most negative point, compared to hanging in and not getting spooked, are very low indeed.

Grant Pearson is Head of Strategy and Distribution, Insync Funds Management

Established in July 2009 by Monik Kotecha and Garry Wyatt, Insync Funds Management Pty Ltd (Insync) is a core global equities manager based in Sydney with Equity Trustees as its RE. A high conviction, bottom-up, quality style manager, Insync employs a valuation-based approach, selecting stocks from a concentrated group of global large cap companies. These stocks must meet Insync’s rigorous filters, benchmarks and hurdles, and be beneficiaries of one or more of 16 global megatrends that Insync has identified are key predictors of growth. They must also consistently allocate capital efficiently, and have a high Return on Investment Capital (ROIC). For more info see https://www.insyncfm.com.au/

| « Mint spearheads letter to the Government addressing Modern Slavery Legislation | The cheap treat that’s getting more expensive » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |