The cheap treat that’s getting more expensive

In this article we look forward to 2024.

Monday, March 25th 2024, 8:14AM

by Castle Point Funds Management

By Stephen Bennie

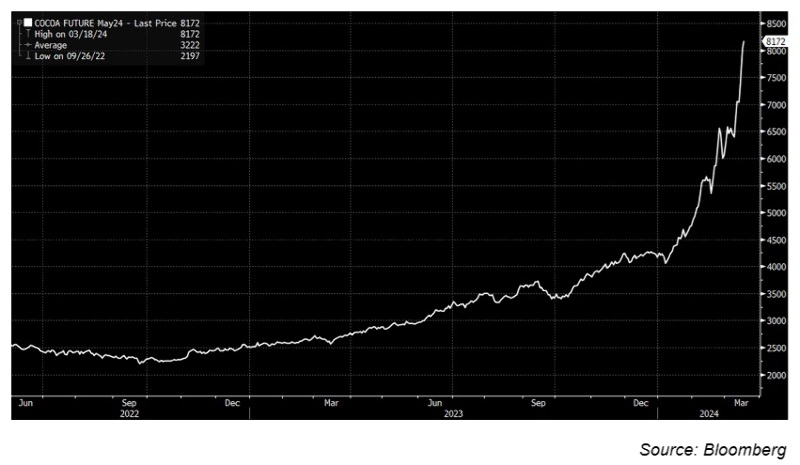

The Easter Bunny is facing a cost-of-living crisis, the price of cocoa, an essential ingredient of chocolate, has been going through the roof in 2024. Don’t be counting on a visit from said Bunny this Easter. It’s generally the case that when the price of a commodity goes up over 250% in a few short months, several factors have combined at the same time. So, what has been going on to create this parabolic price chart.

Chart of the price of cocoa more than trebling in the past year

First as a spot of background, cocoa is harvested from the Cocoa tree which is a very picky tree. It needs rich soil, enjoys the shade but also likes periods of sunshine and needs it hot and humid all year round. Clearly that isn’t a climate we enjoy in New Zealand. Actually, it’s one that only really exists on or close to the equator. Hence its countries like Brazil in South America, Indonesia in Asia and Ivory Coast in Africa that produce cocoa. Of these countries, Ivory Coast is the world's largest producer by quite a margin, it supplies around a third of the world's cocoa.

The world’s growing appetite for chocolate has been good news for cocoa farmers in the Ivory Coast but its been far less great for its native forest and its children. Massive deforestation and widespread child labour has been a feature of its growing trade in cocoa. For anyone interested in getting a bit depressed about the fact that 1 in 4 children, between the ages of 5 and 16, in the Ivory Coast does not attend school and is instead forced to work, most commonly on cocoa farms; go to this website Findings on the Worst Forms of Child Labor - Côte d'Ivoire | U.S. Department of Labor (dol.gov).¹ On the plus side, improvements are being made but it still has a considerable way to go, for example there are still no civil penalties in the Ivory Coast for being found guilty of child trafficking. The Easter Bunny really needs to do some work on its ESG policy.

The best reason for the sudden spike in the cocoa price would be that everyone working on a cocoa farm was now being paid a living wage. Sadly, that is not the reason. The actual reasons have been unseasonably late rain that damaged the cocoa flowers and then a fungal disease that has rotted many mature cocoa pods. This unfortunate combination is estimated to be in the process of destroying 28% of Ivory Coast’s 2024 harvest². Similar issues are affecting the cocoa harvests in Ghana, Nigeria, and Cameroon. Put this altogether and this year’s global cocoa crop is looking like taking a 20% hit to volumes, combine that with steady demand by consumers for chocolate, and the result is soaring cocoa prices.

This turn of events is a timely reminder of how volatile commodity prices can be and how hard it can be to accurately predict that volatility. That said, investors and traders are attracted to commodities for that volatility however unpredictable it may be. I would highly encourage those who have yet to read the Reminiscences of a Stock Operator about Jesse Livermore to snag a copy and read all about how he made and lost fortunes often trading grain futures³.

Curiosity led me to visit The Hershey Company’s investor relations website to see how they were dealing with this bout of commodity volatility. Founded in 1894, this company is now a very large enterprise, a member of the S&P500, with brands such as Hershey’s Kiss, M&M’s and Reese’s Peanut Butter Cups⁴. This makes it one of the largest buyers of cocoa for over the past 100 years.

A quick way to find out about the hot issue facing a company is to read a transcript of the Q&A part of their results call where management take questions from broking analysts. Hence this extract from their Third Quarter 2023 analyst call in October last year.

Michael Lavery (Analyst at the broker Piper Sandler)

Just was wondering if you could catch us up on Cocoa. Obviously, we see the market rates or the spot rates. But you've always done, I think it's anything from 3 to 18 or maybe even more months of hedging and contracting, and can you just give us a sense of maybe what, if anything, you expect the market to do? How you're positioned relative to that? And I know the pricing question came up a little bit earlier and you haven't announced anything, but is there any reason to believe that you would have any different approach than normal where if it remains an elevated source of pressure, you could take the pricing to cover it? Just some thoughts on how all that looks from your seat.

Steve Voskuil (CFO of The Hershey Company)

Sure, I'd be happy to do that. On the Cocoa side, our policies haven't changed. You referenced the hedging horizon, and those fundamentals haven't changed. I would say, as we sit here today, we probably have less visibility on a full year '24 pricing locked in than we might have had in prior years, and some of that is driven by the high pricing right now. But we're staying very close to the market, and of course, that influences other parts of the strategy, as you mentioned, like pricing.

Source: The Hershey Company⁵

Since that call took place cocoa prices have risen by over 130%. It just shows that even an industry participant, that knows the market inside out, can miss a massive move that is trucking down the road towards them.

In hindsight, the correct answer would have been, good question Michael, we are aware that cocoa prices are currently very elevated, but we see risks to the upside, so we have been increasing our hedging. Rather his answer was that due to the current high prices of cocoa we have less hedging in place than we’ve had in prior years. Sort of the opposite of the good answer. It should be noted that The Hershey Company may have had a radical rethink on their hedging after this call. However, the Q&A transcript for their Fourth Quarter 2023 analyst call in February this year suggests that was not the case where they repeated that they had been sticking with their long-term hedging approach⁶.

Overall, this current cocoa episode is a great example of why trading commodities is so difficult to get right, even for an industry expert. The huge but unpredictable moves can make you a hero or a zero as Jesse Livermore knew all too well.

¹ Findings on the Worst Forms of Child Labor - Côte d'Ivoire | U.S. Department of Labor (dol.gov)

² Ivory Coast: Cocoa production expected to fall by 28.5% in Q1 | Africanews

⁴ The Hershey Company - Wikipedia

⁵ Ironwood Capital Management Q2 2023 Performance & Portfolio Update Call (gcs-web.com)

⁶ Ironwood Capital Management Q2 2023 Performance & Portfolio Update Call (gcs-web.com)

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

Stock photos can be found here:

More information can be found at:

Castle Point is the issuer of the Ranger, 5 Oceans and Trans-Tasman Funds. Our Product Disclosure Statement can be found here: Castle Point Funds | PDS

| « Wrestling the gorilla | Art of Investing: A journey from shadows to spotlight » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |