All numbers point north for KiwiSaver

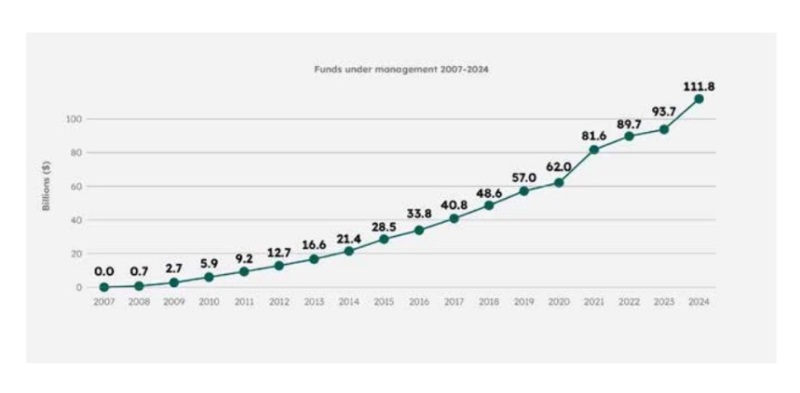

The March 2024 reporting year for KiwiSaver showed the strongest growth in total funds since 2021 and passed the $100 billion milestone, according to the Financial Markets Authority.

Tuesday, September 24th 2024, 1:35PM

by Andrea Malcolm

The FMA’s annual KiwiSaver report says due to compound returns and fund selection, the next $200b will arrive a lot sooner than the first.

There are now 3.3 million people invested in KiwiSaver, about 62% of the total population. Of those, almost three million have selected their own provider and fund.

Ending the financial year at $111.8b, there was a 19.3% increase from last year's $93.6b funds under management with a mean balance of $33,514 per member, up 16.5%.

The year’s growth was due to a combination of strong investment returns of $13.1b up from $1.9b loss, and inflows of $11.2b (up 6.5%) into KiwiSaver through contributions of members, their employers and the government.

FMA director of markets, investors and reporting John Horner said it was pleasing to see individual contributions through salaries and wages were up to an all-time peak of $5.9b this year.

Members withdrew $5b, an increase of 18.8%, including $3b by those over 65 (up 6.4%), $1.2b for first homes and $264.3m(up 82.4%) due to financial hardship. Almost 30,000 members made significant hardship withdrawals, an increase of 60% from 18, 291 last year. However the report said this still represents less than 1% of all KiwiSaver members.

People 65 years or older continued to be responsible for a large majority of withdrawals by value, up 6.4% from last year to $3 billion.

Fees

A gradual decrease in fees as a percentage of funds under management over the last 10 years, wasn’t continued in the 2024 data. Total fees charged by KiwiSaver providers increased, 18.9% - from $664.1m to $789.6m. This was in line with the increase in total FUM and showed fees hadn’t increased or decreased per dollar.

The increase was mainly driven by investment management fees, up 13.1% to $708m and a steep rise in ‘other scheme expenses’ up from $15m to $58m. Admin fees saw a slight rise of 3.3%. Total default fund fees were $13.1m, while total active fees were $776.6m.

KiwiSaver member behaviour changing

Over the last four years the overall investment profile of KiwiSaver has skewed toward growth, driven by more investors making active choices that are in line with their long-term retirement goals.Growth funds represented 46% of total funds under management, with $51.4b invested, and a total of 1.53 million investors selecting a growth fund. This has grown rapidly over recent years, more than doubling from $24.5 billion in 2021.

Horner says compared with previous years, investor behaviour has changed over time, together with the profile of the funds being selected. With KiwiSaver in its 17th year, investors have become more comfortable with the long-term nature of KiwiSaver.

“We believe this is why almost half of all KiwiSavers have moved towards more growth-oriented funds.”

Funds labelled socially responsible increased to $1.4b, more than 30% year on year. The number of people choosing values based funds grew slightly from 45,495 to 47,754.

Switching down

The year to March 2024 saw a further decrease in total switching activity, down to approximately 300,000, an 18% decrease from last year. The total amount of money that moved between funds, but stayed with the same provider, was $6.0 billion, up slightly from last year. The largest number of switches this year involved growth funds, with 130,372 totalling $2.2 billion out, and 116,232 totalling $2.7 billion in.

| « Sharesies KiwiSaver adds multiple-base fund selection | KiwiSaver winners » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |