KiwiSaver winners

Andrea Malcolm looks at the latest KiwiSaver data from Melville Jessup Weaver and finds out who the big winners are over recent years.

Monday, October 7th 2024, 9:06AM

by Andrea Malcolm

Milford, Generate and Simplicity KiwiSaver have each enjoyed massive growth in assets under management over the last five years.

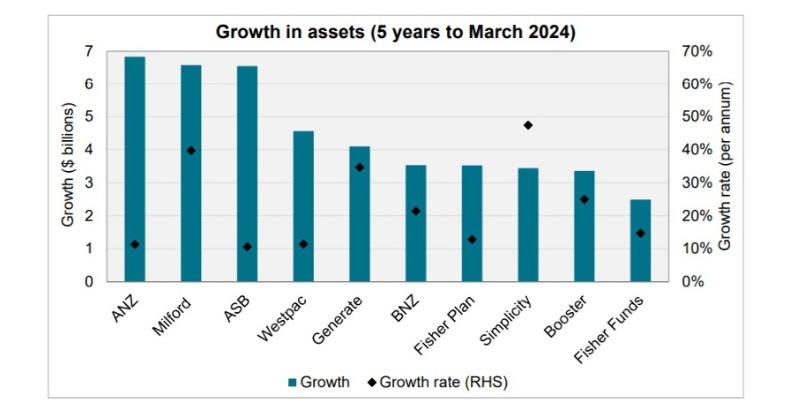

In the five years to March 2024, Milford added around $6.5 billion in assets with a 40% per annum growth rate, while Generate and Simplicity also enjoyed high growth rates of 35% and 47% respectively, according to analysis by Melville Jessup Weaver.

While Australian bank-owned providers saw significant increase in assets (ranging from around $3.5b for BNZ to almost $7b for ANZ), this came at relatively low rates of growth.

For the financial year to March 2024 and allowing for aggregate ownership of multiple schemes by ANZ, Fisher Funds and NZX; ANZ retained great market share at 19%. Below that several positions were traded over the year with Fisher Funds leapfrogging ASB for second place, Milford passing AMP for fifth and Generate pipping Booster for eighth.

However, KiwiSaver remained a very skewed market with the largest three owners accounting for about 50% of members, and the largest ten accounting for about 90% of members.

Among the smaller providers, big movers were Sharesies (up seven spots) and Kernel (up four). In terms of absolute growth, Milford, Fisher Funds, ANZ and ASB each increased by over $2 billion AUM. When considering the percentage gains, the leaders were Sharesies (which started from a near zero base), Kernel, Kōura, Aurora and KiwiWRAP – each of which more than doubled its assets.

In terms of membership growth, the biggest winners for the year in absolute terms were Milford, Generate and Simplicity. At the smaller end of town, Sharesies, Kernel, Kōura and Aurora all saw substantial growth from lower bases.

This year saw little change in the market make-up, with no new entrants. However, five schemes have been rebranded in recent months: Kiwi Wealth to the Fisher Funds Plan, Nikko to GoalsGetter, Juno to Pie, Select to JMI Wealth, and Lifestages to SBS.

The number of default members rose slightly from 325,000 to 341,000 but as at 31 March 2024, only about 10% of KiwiSaver members were classified as default, down from almost 25% in 2011.

Member profiles

Digging into membership profiles, the highest average member balance went to adviser-led KiwiWRAP ($173,300), although at around 400 members, it was one of the smallest providers. Also at the high end MAS ($86,200), Craigs ($82,900) and Miford ($75,900) members had relatively high average balances compared to the national average of $33,500.

KiwiWRAP also had the highest proportion of members contributing at year end at more than 90%. Second was the restricted NZ Defence Force which was narrowly ahead of Kernel (over 85%) for each.

| « All numbers point north for KiwiSaver | Tattoo removal and IVF companies are part of Generate's new PE deal » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |