What happens next to the ultimate political football

Thursday, June 7th 2001, 4:05PM

So, the Greens have said "no" and, unless the government can convince New Zealand First to back the New Zealand Superannuation Bill, it might not have the numbers to pass the New Zealand Superannuation Bill. The Minister of Finance is seemingly defiant. He intends to set up the Big Cullen Fund anyway; running it informally within the Treasury without enabling legislation. If there's nothing to stop such a genetically re-engineered clone (the "Big Cullen Demi-Fund"?) it makes a bit of a mockery of the need for the New Zealand Superannuation Bill in the first place, n'est ce pas?

Anyway, such a fund may not be consistent with the Fiscal Responsibility Act. That requires the government to reduce Crown debt to a prudent level and then maintain it at that level. Would it be prudent for the government to have debt at a higher level than needs be so the government can invest in "risky" assets? Possibly not.

Voters could be excused being deeply cynical about the surreal position the government finds itself in. It's now completely dependent on Winston Peters' support. And he wants a scheme that was rejected by 92% of voters less than four years ago. Somehow, the government has to look as though it goes along with Mr Peters without agreeing with him. Is this consensus or what? Why is superannuation seemingly such an intractable subject?

What's wrong with the Bill?

I don't want to go on too much about what's wrong with the Bill

but those who haven't been following the argument might appreciate

a crash course, just to set the scene for the real point of this

piece.

The future cost of New Zealand Superannuation

is the pensions that will be paid. In general terms, that future

cost has nothing to do with the way the pension is financed but

with the amount that is paid. This Bill and all the debate that

has gone on over the last 25 years have not addressed one single

aspect of the design elements that drive the benefit design of

New Zealand Superannuation. Specifically, we have never had a

properly researched discussion on the:

- state pension age;

- dollar amount paid;

- inflation linkage;

- qualifications for payment, including income and/or asset tests;

- relationship between the married and two different single rates.

That just about covers every single important part of the design.

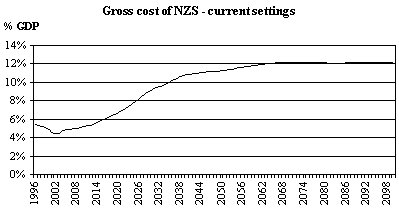

The baby boomers aren't the very long-term problem either though they will cause relatively short-term pressures over the next 50 or so years. Superannuation costs won't reduce once the baby boomers are all dead, say, by 2060. The costs increase steadily over the period after 2050 and top out at about a gross 12% of GDP by 2100 (about a net 10%) - see the chart.

Note: source - PRISM, a modelling tool developed by the Super 2000 Taskforce.

The government justifies the Big Cullen Fund by focussing on the cost between 2030 and 2050 by which time the net cost will reach about 9% of GDP. The government apparently isn't concerned about the generations of taxpayers after 2050 and, particularly after 2100 when the last dollar will have been paid from the Big Cullen Fund.

My main gripe with the Bill is that we haven't debated any of the design elements of New Zealand Superannuation. The government is actively discouraging discussion on the real issues. Why don't we talk about what we have to pay for before we discuss how to pay for it, never mind whether we can pay for it in the first place?

The most the Big Cullen Fund can hope to achieve is a minor contribution to inter-generational smoothing of cash flows. That doesn't make New Zealand Superannuation more sustainable as the government claims.

When the Bill is reported back to Parliament by the Select Committee on 12 June, it should be defeated.

So what happens next?

The last National government fell flat on its face with its attempt

to lower the married couple's New Zealand Superannuation from

65% of the national average wage to 60%. However, it had already

shamefully neglected the Superannuation Accord and so had lost

its credibility on superannuation policy.

Now, there is some prospect of the present government's dropping this ultimate political football. The poor pollies must be wondering what to do next. How can they get this vexatious superannuation monkey off their backs?

I want to make a few suggestions and that's what this article is really about.

I was part of the first Todd Task Force that recommended establishing the Retirement Commissioner's Office. The role of that Office was described in our final report - it was mostly about informing and educating the public on issues related only to private provision for retirement.

I think it's time to revisit the Retirement Commissioner's role and status. That's also appropriate because, apart from the coming roadblock in the debate on public provision, we now have the unseemly spectacle of the private sector's withdrawing financial support from the Retirement Commissioner while at the same time, the government is apparently saying there's no more money from the taxpayers. I think some in the government would actually prefer the Office of the Retirement Commissioner to wither and die. They're not the only politicians who think that. They just don't like any sunlight being shone on the issues - it makes their policies look a bit threadbare.

I want to suggest a new, wider role for the Office.

None of the pollies now has any credibility with the public on superannuation issues. So why not literally shift the ground on which the debate takes place to outside the mucky political trenches? We need a proper national debate on New Zealand Superannuation's key design issues. We've never had one before. But before that debate can start, there's a lot of information we need so that we're all at the same starting gate.

Why not ask (OK, tell) the Retirement Commissioner to run the research and the required debate? The pollies can take part if they wish and they should be encouraged to do so (OK, publicly humiliated if they don't). Anyone can contribute and the Retirement Commissioner should aim to hear everyone's views, no matter how nutty. If someone really believes that forced private saving is the answer to all our retirement income ills, give him his time in the sun and answer the proposal with researched responses. That kind of individual attention is now practicable through Web site technology - the research, the proposals and the responses all need to be in the public arena.

This will be quite a long process because there's such a lot that we just don't know. However, we've got nowhere in the last 25 years so another couple of years won't matter too much.

Here are just a few questions about New Zealand Superannuation that I want to see answered with some proper research, before the debate can begin, not, as has been customary, after the pollies have made their decisions:

- What might be the economic, welfare and labour market consequences of changing the state pension age from 65 to, say, 68 or 70? What if we allowed some choice about the starting age with actuarial adjustments for early and late starts? We really haven't a clue about any of this at present. We can all make educated guesses but no-one really knows.

- What are all the implications of changing the relationship between the married and single pensions? Why is the single person's pension set at 60% of the married couple's? What's the basis for the extra amount paid to single people who live alone? Is it enough/too much?

- Should New Zealand Superannuation be the same in Auckland (where housing costs are high) as in Invercargill (where housing costs are so much lower)? Why is it linked to the national average wage? Are there alternative, fairer ways of protecting its purchasing power?

- What are the implications (social, welfare and economic) of having New Zealand Superannuation set at something other than a net 65% of the net national average wage? What is the pension amount trying to achieve? We don't know other than it's set at a level that doesn't seem to provoke too many complaints and so might not lose the next election. Is that a reasonable test of reasonableness? It might be but who knows?

- What are the implications of income and/or asset tests for New Zealand Superannuation? Can we design an arrangement that is simple to administer, fair and has popular support? The pollies will run a mile from that suggestion but the Retirement Commissioner should at least try. We should certainly debate the arguments for and against rather than consign the issue to the opaque business of coalition compromises (as happened in 1997).

One of the major problems all the political parties face is that even asking questions about any of this stuff is a potential admission to the others that they may be thinking of change, even 20-30 years down the track. So the questions don't get asked and we get dopey "solutions" like the New Zealand Superannuation Bill as the answer to all our problems.

Changing the ORC's structure

The Retirement Commissioner's role can't be widened in the way

I suggest without some changes to the Office's structure and financial

support. I think the Retirement Commissioner should be made an

Officer of Parliament and should not have to go down on his knees

for money from the savings industry. Apart from anything else,

there's a lot wrong with the way some parts of the finance and

financial planning industries work. The Retirement Commissioner

should be able to slap wrists and publish league tables without

the risk of having his funds cut off.

If he's going to lead a properly researched debate then the Retirement Commissioner will need a decent dollop of public money to do that. And that's OK because remember that New Zealand Superannuation now takes about $5 billion of our tax money and is the largest single item of expenditure in the government's budget. That will become about $10 billion of today's money in the next 30 years. Even if the Retirement Commissioner's budget were as much as $10 million a year for the next few years, that's still only 0.2% of each year's New Zealand Superannuation payments. Surely we should be happy about spending that so that we know whether the other 99.8% of that huge expenditure achieves its objectives, whatever they might be.

Having got the debate going and having become the source of credible information on the whole issue, the Retirement Commissioner can knock a few political heads together from time to time. I want him to be pro-active on this front. In today's environment, for example:

- He should tell Labour that the Big Cullen Fund won't work; that Michael Cullen's TEt proposal probably won't work either.

- National should be asked to justify its proposed tax incentives (What will they achieve? How much will they cost? What's wrong with what we do?).

- He should ask ACT to explain, in detail, how its "savings-based" solutions will work. Does ACT really want an income and asset test?

- He should ask the Greens why they support "65 at 65" (65% of the national average wage from age 65) and what alternatives the Greens have considered in coming to that conclusion.

- We could have saved $20 million or so if he had been able to say to the last government that the referendum on the Compulsory Retirement Saving Scheme was a waste of time.

And so on.

The pollies won't like this kind of attention but the quid pro quo will be that political parties should be able to put forward suggestions about policy changes without the opprobrium they currently risk gathering. It will also probably lift the quality of the suggestions made by our elected leaders (Pavlov's dogs and all that).

There is an alternative

In my view, the 1993 Superannuation Accord happened because Jeff

Todd had gained credibility through his leadership of the Task

Force and because he knew so much more about the issues than the

then crop of politicians. His patient insistence on dealing with

the things that really mattered meant that MPs had to answer the

important questions and not be diverted by issues that might frighten

the political horses. In this business, Jeff showed again that

knowledge is the real key to quality decisions.

New Zealand has made practically no progress on public provision for retirement over the last 25 years, mainly because low-grade policies have been developed by people who don't know what they're talking about. I've now seen that process at work close up and that really is what actually happens. It isn't a pretty sight.

Let's turn the Office of the Retirement Commissioner into a centre of excellence on all retirement income related issues (both public and private). I urge those politicians who are thinking of voting against the New Zealand Superannuation Bill to stick to their guns. There is an alternative.

| « Fund's rules present problems | AMP & Good Returns launch superannuation website » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |