Quantitative investment styles, and when they perform

Factor investing as a style has become increasingly popular in the last decade with the rise of Smart Beta funds globally. These strategies are expected to outperform the market over the long-term.

Monday, August 28th 2017, 10:02AM

by Susanna Lee

Each different strategy selects companies based on favourable characteristics defined by the strategy. There are many different factors such as risk based factors (value and size) that command a premium, fundamental factors (growth and quality) that are specific to the performance of a company, or behavioural factors (momentum and volatility) that are present in data but have no risk or fundamental explanation.

Harbour selects factors that have significant academic and empirical evidence. As a fundamental equity manager, Harbour believes it is important for factors to have an underlying risk or fundamental reason for their existence (rather than something that just exists in the data).

Factor portfolios provide increasingly important characteristics to manage portfolio risk and return profiles by choosing securities based on attributes that are associated with higher returns such as size, value, yield and growth.

Each factor can have its own unique performance cycle and it may be expected to outperform the market over the long term. Factor investing (especially in individual factors) will not work all the time, and there are times where some factors will underperform for periods of time.

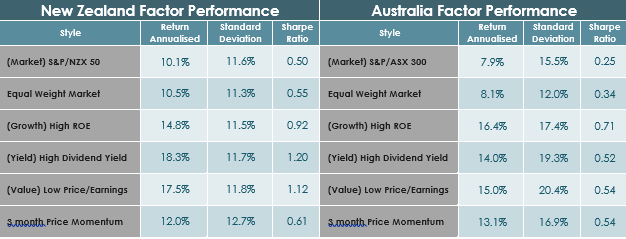

Table 1 below shows the performance of a selection of strategies in the New Zealand and Australian Markets.

Table 1: Performance of top quartile of factor strategies.

Source: Bloomberg, Harbour. Data from 2004 to mid-2017. Portfolios are rebalanced monthly. Each style except the equally weighted strategy consist of the quartile that is expected to outperform. Growth selects the top quartile of stocks with high return on equity (ROE). Yield uses the top quartile of stocks with high dividend yields if earnings per share exceed dividends per share. Value selects the bottom quartile of stocks that are cheap on a price to earnings basis. Momentum selects the quartile of stocks that had the highest return over three previous months. Equally Weighted Market takes all the stocks in the index and weights them equally.

We have suspected for a long time that factors are linked to the economic cycle, and have set out to find proof of this point. We looked at two independent data sets; New Zealand’s top 50 stocks and Australia’s top 300 companies. The results were strikingly similar, which gives us confidence in the conclusions.

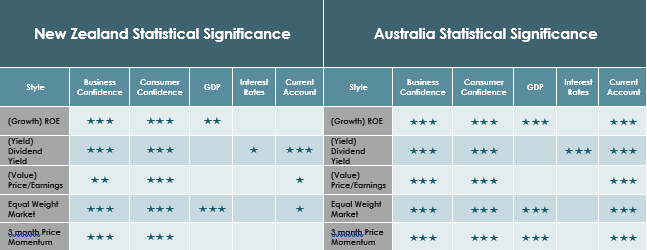

Table 2 illustrates that the different factor strategies from Table 1 tend to be driven by economic variables.

Table 2: Economic drivers factor strategy performance.

Source: Bloomberg, Harbour. Data from 2004 to mid-2017. The outputs are t statistics and measure statistical significance. Statistical significance level: 2.5% = ***, 5% = **, 10% = *. The strategies are defined in the footnote for table 1. The dependent variable (Y) is the strategy return (Quarterly) and the independent variable (X) is the economic variable (Quarterly). Business Confidence is the quarterly change in the level of Business Confidence. Consumer Confidence is the quarterly change in Consumer Confidence. GDP is the change in quarterly GDP. Interest Rates is the change in the level of the 10 year government bond rate quarterly Current Account is the percentage change in the current account.

Leading indicators such as business confidence and consumer confidence appear to be a strong explanatory variables across all equity strategies. This is logical, because when businesses are optimistic they invest, when consumers are optimistic they spend, and investors invest in riskier assets (for instance, equities).

Growth is defined as earnings growth, and is structural in nature with links to the economy. Growth indicators are strongly related to the changes in GDP. This passes the sensibility check, because earnings typically have a strong positive relationship to GDP. When company earnings are growing, GDP is likely to be high as well.

Yield stocks are often mature defensive companies that pay out their profits and grow their dividends. The Yield strategy has a strong positive link to the change in the long term government bond rates in New Zealand and Australia. As rates increase, demand for yielding fixed interest assets increase and fixed interest securities become more expensive. This drives increased interest in equities and yield stocks for those searching for income.

Value relates to stocks that are cheaper than their peers when using comparable multiples (such as Price to Earnings). Value has no statistical relationship to the change in GDP or change in interest rates. Value is more cyclical in nature and correlated to medium term fluctuations in the business cycle.

Equally-weighted portfolios can be a proxy for a small stocks bias. Small market capitalisation stocks are increased in size in the portfolio relative to their large counterparts. These are generally sensitive to structural aspects of the economy such as GDP.

There are some structural differences between the New Zealand and Australian equity markets.

In New Zealand, Value, Yield and Small stocks have a strong relationship to the Balance of Payment Current Account. This reflects the businesses exposed to the import/export industries and, in the case of Yield, the amount of overseas ownership. In Australia, all strategies have a strong link to the Current Account, because the S&P/ASX 300 is different in composition to the New Zealand market. In particular, there are many resource, metal and mining companies that are driven by similar factors to the Current Account.

Three month price momentum has different results for New Zealand and Australia. Momentum is an anomaly, which means it has no risk-based explanation. The explanation for momentum is often linked back to behavioural biases such as herding.

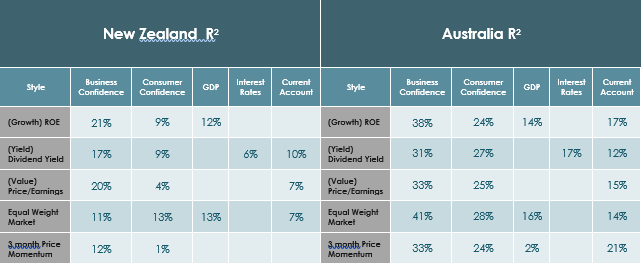

The R2 is a good measure to determine how much of the variability in a factor strategy’s performance can be explained by movements in the economic variable.

Table 3: R2 the degree the strategy performance can be explained by the economic variable

Source: Bloomberg, Harbour. Data from 2004 to mid-2017.

Generally more than 5% of the variability can be explained by movements in one economic variable individually. This tends to be higher for Australia. Although this may appear low, we can see that multiple economic variables impact stock returns, and in aggregate this is more significant.

If you can forecast what will happen to leading indicators, GDP, the Current Account and the change in interest rates investors can tilt their factor exposure in their portfolios accordingly. If an investor is expecting business and consumer optimism and an improvement in GDP, they could tilt their portfolio towards riskier assets such as equities, in particular a growth strategy. If the reverse is true, value and yield equity strategies are likely to perform better than growth.

In the absence of economic prediction, or if you want to design a portfolio that will perform well in all cycles, Harbour believes the best way to utilise factor investing is through a diversified approach to portfolio construction. By holding more than one factor exposure (such as Value, Yield and Growth) an investor can increase expected return over different market cycles, and the diversification of factors decreases the deviation from the market return (risk).

Harbour believes in fundamental equity management. Hence, we believe it is important for factors to have a risk basis or fundamental explanation for their existence, rather than being an anomaly described by something behavioural and often irrational, that may cease to exist.

This column does not constitute advice to any person. www.harbourasset.co.nz/disclaimer/

Director at Harbour Asset Management

| « The global economy: weak household incomes constrain outlook | Responsible investing: Is there a cost? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |