nib aims to make advisers' lives easier with online tool

Health insurer nib aims to get the majority of policies issued in real time by the end of the year.

Friday, August 16th 2019, 10:49AM

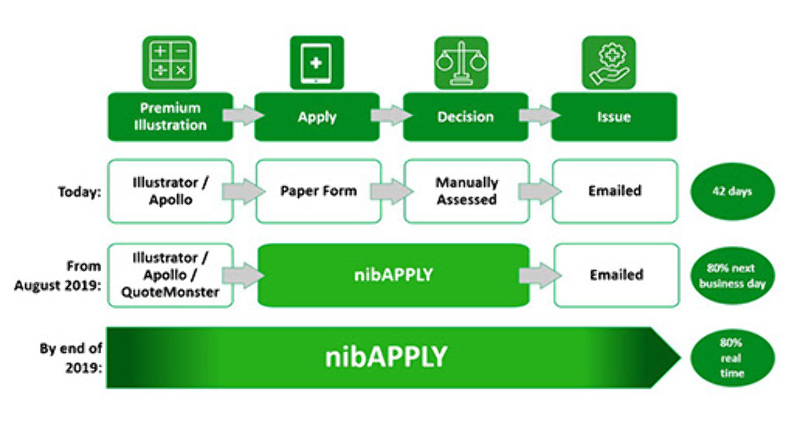

The company is launching a new online application tool, NibApply later this week, which it says will make it faster and easier for advisers to deliver health insurance solutions to clients

It is intended to significantly reduce the time it takes advisers to complete, submit and cover a decision on health insurance applications.

Chief executive Rob Hennin said it was part of a commitment to support advisers. While this week's launch is the start of an end-to-end solution, which will in the future include premium illustrations, and with up to 80% of policies issued in real time.

“We’ve made the client join experience fun, fast and easy through dynamic questions and automated real-time underwriting and decisions that are all done online, removing the need for paper-based application forms,” Hennin said.

“The interactive, easy-to-use tool will significantly reduce the processing times of health insurance applications. By the end of the year, we expect up to 80% of applications to be accepted in real-time, resulting in immediate health cover for the majority of our clients,” he added.

The launch of nibApply follows the introduction of nib’s enhanced adviser distribution model, which works closely with advisers to help ensure their clients have health cover that protects them and their families.

“Our advisers are a crucial part of our business and we value their support and feedback. Our recent Health Comes First roadshows – where we introduced advisers throughout the country to our enhanced adviser distribution model and new dedicated adviser support team – proved to be hugely successful,” Hennin said.

“We always welcome the opportunity to engage with advisers first-hand. In fact, nibApply was developed in a design-led approach with input from both clients and advisers, to ensure the capabilities of the application would address their needs and provide a user-friendly experience,” he said.

| « AIA says Vitality is flying as another insurer tries to shoot it down | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |