Partners Life to pay override commission to advisers

Partners Life is making major changes to its commission payments which will see payments made to FAPs based on customer outcomes rather than to dealer groups.

Thursday, March 19th 2020, 1:31PM  19 Comments

19 Comments

Naomi Ballantyne

Partners is no longer paying override commissions to dealer groups. This is likely to have a major impact on some groups which relied on these commissions to run their businesses.

These payments, and fixed dollar marketing support, will stop on July 1.

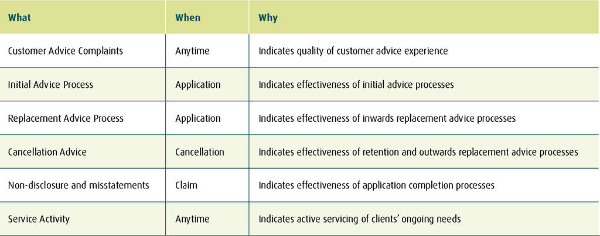

Instead the life company will pay overrides to FAPs and payment will be made based on customer outcomes including initial advice and replacement advice process, cancellation advice, non-disclosure and misstatements, service activity and customer advice complaints.

“We are redirecting all previous over-riders and fixed dollar support payments into FAP over-riders (FAPOs) which will be payable to FAPs.”

These overrides will be based on the bonus commissions earned by the advisers within the FAP.

“This financially aligns the interests of advisers and their FAPs with customer outcomes.”

Partners Life managing director Ballantyne says these changes and some changes to commission structures are about who gets the money, rather the quantum the company pays out.

“It is the same amount of money in the system,” she says. “the difference is whose hand it goes too.”

In the past money had gone to dealer groups but hadn’t been used in the way it was intended. Under this model the adviser will make the decision how to spend the money to grow their business.

There is potential criticism that the money won’t be spent on the business, but Ballantyne doesn’t think this will be a big issue as adviser are facing increased costs and will need support.

Ballantyne says the changes are being made in response to pressure from the regulator.

“The regulator thinks that upfront commissions are too high and can incentivise poor adviser conduct.

“We want to demonstrate that commission can incentivise good adviser conduct.”

She says advisers will face increased costs in running FAPs, and these changes are designed to support FAPs.

Partners Life has been encouraging advisers to be become FAPs through the transistional licencing process.

“We are encouraging as many advisers as possible to become their own FAPs,” she says.

If they have a licence then they are keeping their options open.

Measuring customer outcomes

Partners has developed a points matrix to help measure customer outcomes and this will be released soon.

Measurement and reporting on these outcomes will start on April 1. However, scaling of the commission bonus will not start until March 31 next year.

This one year transition period is designed to facilitate an understanding of customer outcomes being achieved by each adviser and to provide a reasonable time period for advisers to adjust their business practices.

Advisers will get feedback each month on how they are going.

Ballantyne says the process will “encourage people at the bottom to change their behaviour.”

Adviser bonus commission rates will remain at current levels during this period.

Partners will be contacting clients at application time to measure an adviser’s performance. Ballantyne said was wasn’t appropriate for the company to be involved in the process earlier as that would be a potential conflict.

“We are not expecting to find a lot of issues,” she says. However, when they do they can help the adviser improve their processes.

She expects that there will be pushback from some advisers, but they have nothing to fear if their advice process is good.

| « Partners puts hold on redundancy cover | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

They have just changed their modus operandi to suit the well telegraphed changes required by Partners et al. Not sure that the FMA will see it this way but time will tell. Won’t raise the standards of behaviour in these groups.

Just business as usual in drag.

Well said Amused, exactly what I have been saying for months.

@Wondering, Newpark isn't heading down the FAP route for their risk operation so this doesn't apply to them in the way you have suggested. Frankly, it means that the revenue stream for their business is going to be massively disrupted, as it is about to get turned off.

Because they took that stance early they have expected and planned for this outcome. What they do now it has been confirmed, we are all yet to see.

For the others that have beaten the drum on "join our FAP" it is going to be interesting to see what happens with them, they are the ones that are more precarious with the way they are presently operating.

Again a theme that I have had a lot to say about in the last 2-3 years. Because I've been a lone voice against the noise, doesn't make the noise right ;)

One thing is certain the industry bodies looking to separate advisers from their money isn't going to be any easier. And the suggestion that dealer groups will just clip the ticket from the adviser is as naive as the idea that this will be business as usual.

It is going to be a long way from business as usual for the majority of advisers. Even those that do well now are going to face significant changes and requirements to meet the compliance required.

Also with this additional funding from PL to advisers, how does this create good customer outcomes, why don’t we all support PL simply because we will get more $. I’m not sure this decision drives the correct behavior!

>>Partners Life has just signalled to the industry that payment of the override will now go to the adviser directly if they elect to become their own FAP as opposed to them working under a dealer group FAP.<<

I am not sure that this is what they are saying. My interpretation is that any funding will go to the FAP rather than the simple aggregator/dealer group. If the dealer group is also the FAP then my expectation is that they will receive any funding in order to support the services provided by the FAP. I am a mamber of Wealthpoint and my preference would be that providers supported the FAP which is taking all the heavy lifting from me and allowing me to operate my business efficiently, productively and compliantly.

The bigger question for me is whether any dealer groups (in particular large ones) currently indicating that they will be a FAP for their members will actually walk the talk and be prepared to do all they have to.

Hi Tony. If Wealthpoint whom you belong to become a FAP then they will be the beneficiary of the override payments. However with every adviser required now to be licenced for the advice they give to customers working under Wealthpoint’s FAP licence means you will be beholden to them going forward. Essentially you will become a quasi-employee of Wealthpoint as they will be liable for the advice that you give to YOUR customers. This is why licensing was never designed with dealer groups in mind. As I noted above licensing is supposed to be about holding to account the individual giving the advice. That can never be applied to a dealer group without significant consequences to an adviser and his or her business.

With the above in mind I don’t believe many established insurance advisers will want to operate under a dealer group FAP, especially if they can now be eligible to receive override payments from insurers like Partners Life. An adviser becoming their own FAP makes so much more sense for the future.

Mr DG, I (provider) would like to see a copy of the Statement of Advice you provided, to the client you sat down with, so I can ensure that the good client outcomes are being achieved.

There is they reason they should be treated differently, they don't give advice. The fact they are accountable for the advice given by advisors is their choice but doesn't qualify them to receive any remuneration from providers going forward.

DG's need to realize that the good old provider gravy train no longer exists for them. They need to make sure they have a solid offering, but any future override commission will be paid to them via the adviser operating under them, not the providers.

They better have a strong offering.

You appear to overlook the fundamental feature of the new (now delayed again) regime.

Who will a financial adviser provide advice on behalf of?

The future answer is not him or herself.

The financial adviser at law will provide their advice "on behalf of the financial advice provider(s) to whom they are linked.

Now some FAs will be their own FAP, others will be employed by an institutional FAP, some may operate through a DG FAP.

David's question is absolutely right - why should all of these different types of FAP be treated differently?

In the mortgage space, the lenders currently pay commissions to the head groups, who then distribute all or most of that remuneration to the actual advisers who wrote the business.

The life insurance space has been different - individual agents have been able to have a direct relationship to the provider. The providers have paid these individual agents direct. In some cases like managing agencies, the commissions are paid at the managing agency level, who then pay out to their sub-agents.

But the providers have also provided overrides to the likes of dealer groups.

These historic life insurance arrangements are now being disrupted - will be interesting to see if providers decide they should join the lenders and pay commissions not to individual advisers as at present but rather to the FAP those advisers are linked to.

We'll all have to watch this space.

The future answer is not him or herself.

The financial adviser at law will provide their advice "on behalf of the financial advice provider(s) to whom they are linked.<<

The old world (and possibly new) where dealer groups tended to supply aggregation of product and possibly a few additional services, CRM etc did not take responsibility for the advice. They were supported by providers for productivity. The new world is very different and I believe that providers will support FAP's who demonstrate that they are acting as such, ensuring compliance by offering a decent raft of what is required of a FAP to their members. For example, AML, Disputes resolution, PI, solid compliance audit, tools and templates, training and personal development and above all accepting responsibility for the advice given. Whilst some 'dealer groups' have indicated that they will become FAP's I am not convinced that all will have the ability or the balls to fulfil their obligations in a manner I believe will be required. In my opinion a FAP should be very careful on who is permitted to be a member within it. The old world of packing the numbers to increase volumes and margin is gone. For providers to have the confidence that their products are being advised on correctly they will need that level of comfort to be displayed by the FAP in question. Small FAP's can easily do that but I am not sure how cost efficient that will be. Large FAPs will struggle unless they have solid procedures and support in place. Dealer groups simply offering a few added benefits will not cut the mustard.

We all need to accept that the gravy train is no more, and those out there trying everything possible to reserect it need to realize that and change their modus operandi.

If the middle man is enhancing your business in a way you either can't do or chose to not do for yourself, and the middle man take a clip for doing that then it has the potential for being a wonderful business model.

Your post presumes that the individual can get the same terms (and for the discussion think way beyond commission aggregation) by themselves. A dealer group which becomes a FAP and fulfils it's responsibilities to it's members by supplying all of the regulatory requirements and support need to be paid for the operation.

The dealer group which clips the ticket and fails to support will likely fail as members realise they are paying twice - once to the dealer group for promised services and once to augment what is missing but required.

Too much focus is on revenue and not sufficient on business efficiency.

You have presented two scenarios: those who join a large group, with standardised documents and processes, lack of individual control and choice, extensive oversight, and all the cost that comes with it; and those who "take this lightly".

Careful examination of reality would reveal a great many of us sit (rather comfortably) in the very spacious ground in the middle of those two alternatives.

The real trap I think, lies in the overall context of Dave's comment: that having your own FAP was too risky, and costly.

I prefer my own take on things - that being in a large DG type FAP that may over-react to things, or take its own interoperation of regulatory requirements, perhaps take actions that are about being seen to be overtly compliant to protect the many, is both unnecessarily expensive and risky.

Class C will come with significant controls required to meet the requirements and those controls, after something that looks like the government trying to contain covid at the border transpires, the idea of sitting under a FAP doing it your way will go west like the life insurance incentive trips. And maybe up there with unicorns and rainbows in reality.

@Majella you failed to read between the lines. Newpark risk had taken a license that was planned and before this broke.

As to being a FAP for all and sundry, that is yet to be seen and hasn't been fully delivered to the market as to what that is 5 months down the track.

So far it is still noise. A bit like the NZFSG and KEPA noise that has been said to be a done deal, yet there seem to be some sticking points, if the rumours are to be believed, which is to say it's not a done deal until the ink dries.

The noise around all of won't be the first, or the last, we hear about the challenegs of running a bigger distribution operation under the new licensing scheme.

Sign In to add your comment

| Printable version | Email to a friend |

Well said Naomi. Unlike the banks it’s great to see an insurance company get their head around what licensing is supposed to be all about. Licensing of the financial services industry was never designed with dealer groups in mind. A dealer group does NOT give advice to your customer, YOU the adviser do. Licensing is supposed to be about holding to account the individual giving the advice. That can never be applied to a dealer group without significant consequences to the adviser and his or her business.

Most dealer groups are mortgage aggregators whose focus is supposed to be on their mortgage advisers. However, override payments from the insurers have become very lucrative with up to 30% of the API been paid on a policy issued by an adviser. When you consider the combined API production of various groups members it’s big money for these dealer groups to have going into their coffers every month. Whilst some of the groups like Newpark have been investing this money back into their members businesses most of the dealer groups have not.

Partners Life has just signalled to the industry that payment of the override will now go to the adviser directly if they elect to become their own FAP as opposed to them working under a dealer group FAP. Insurance and mortgage advisers who have perhaps been quietly sitting on the fence about whether to work under a dealer group FAP or become their own FAP have probably just had their minds made up for them with this news. When advisers start crunching the numbers in terms of extra revenue earned it’s a no brainer. We can clearly see now why dealer groups such as Astute, Kepa, Mortgage Link and NZFSG have all been encouraging their members to work under their dealer group FAP licences. The monetary incentive from overrides means these dealer groups simply do not want their members opting to become their own FAP.

When insurance companies like Partners Life will now deal directly with you under you own FAP and pay you the override commission which was formerly only available to dealer groups why would you still elect to work under a dealer group FAP? The amount of support been provided to advisers nowadays by Partners Life around regulation, compliance and the advice process dwarfs anything that the dealer groups are offering to their own members. Let’s not forgot Partners Life has also made available at no cost to accredited advisers the wonderful adviser support programme to help advisers through licensing. With all the money that dealer groups have been making from overrides over the years it’s telling that none managed to provide an adviser support programme to their members to match what Partners Life created at their own expense.

With a FAP been legally responsible for the advice that it will give to customers any adviser who elects to work under a dealer group FAP will essentially become a quasi-employee. Just think about that for a second and what it means for you and your business. Most advisers in New Zealand operate their own businesses and want to continue trading under their own established names. Working under a dealer group FAP licence will be the first step to you losing this independence. To think otherwise is naïve. In time you will be changing the name above your door to whatever your dealer group master wants you to. And meanwhile that override commission that you could have been earning yourself now is still going into your dealer group’s own pockets.