Enormous leap in housing stock value

The country’s housing stock has grown to a massive $1.39 trillion, skyrocketing almost $200 billion in the year to December – despite the Covid-19 pandemic.

Monday, April 19th 2021, 10:16AM

Reserve Bank data shows the combined value of residential properties rose from $1.19 trillion in December last year.

Housing stock includes all private sector residential dwellings – detached houses, flats and apartments – lifestyle blocks with a dwelling, detached houses converted to flats and home and income properties.

By comparison, the country’s annual gross domestic product (GDP) is $322 billion.

The growth in the value of the country’s housing stock shows no signs of slowing down.

Data from the CoreLogic House Price Index (HPI) shows the upwards trajectory of house prices continued through March, rising 2.2%. This takes annual growth to 16.1% – the highest rate since January 2006.

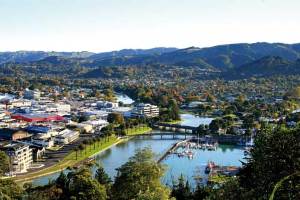

The granular index data shows consistent growth across the country, including in Tauranga which showed some weakness in the prior month’s results.

Monthly growth across Tauranga of 2.5% fully reversed the dip in February, with values now up 2.4% over the past three months.

A scan over CoreLogic’s provincial centres’ data reveals further strength around the country. The main surprise being the -2.4% monthly drop in average value in Gisborne, previously the standout area due to prolonged strong growth.

However, market fatigue may now be setting in, with the average value of $531k stretching affordability in the country’s easternmost city. Once again the lesson of Tauranga remains – one month of data does not make a trend.

The likelihood of further intervention from the RBNZ has dropped especially with loan-to-value ratio restrictions for investors to tighten on May 1. This move is expected to reduce demand and dampen upward pressure on prices.

Early market indicators again become invaluable from both a supply and demand perspective, says CoreLogic. The number of market appraisals generated by agents provides a lead indicator of listings coming to market.

Appraisal numbers have remained relatively consistent over the month, which is good from a supply perspective as the country remains at near all-time low levels for properties on the market.

Meanwhile the volume of mortgage related valuations ordered by banks had already started to dip in the second half of March, but stabilised at the end of the month.

CoreLogic says this will be of key interest in the coming weeks as investor behaviour adjusts to the reduced attractiveness and profitability of the property market.

| « House prices hit new highs | Could fear of overpaying shift housing market? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |