Short house price surge possible post lockdown

CoreLogic says there could be a short period of excessive house price rises after the lockdown because of tight listings.

Friday, September 3rd 2021, 1:51PM

Head of research Nick Goodall says through lockdowns it is harder for agents to source leads and for sellers to prepare their property for sale.

“Tracking of early market indicators, like appraisals generated by agents using Property Guru and RPNZ, shows real estate agent activity has dropped by 52% compared to the week before lockdown.

“This further tightening of supply could lead to some temporary upwards price pressure as pent up demand competes for limited listings.”

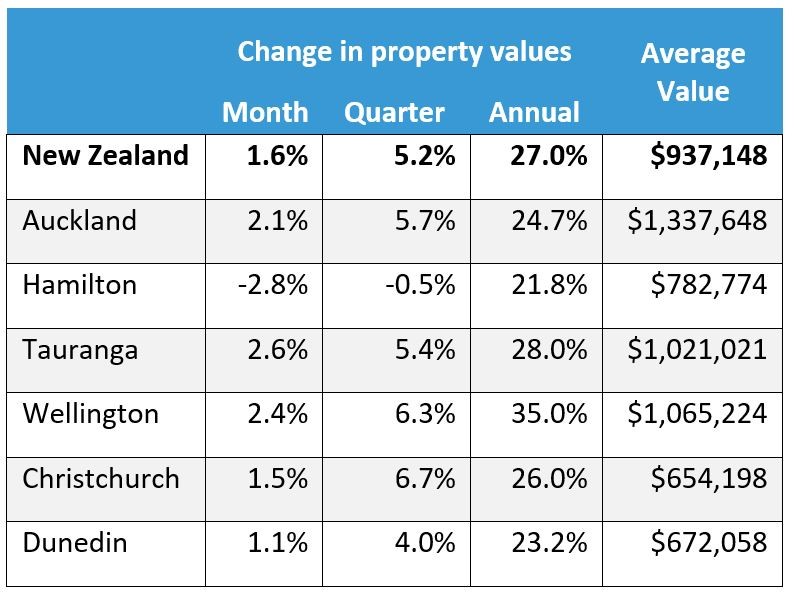

Although listings continue to be tight, CoreLogic’s House Price Index shows a drop in the monthly growth rates.

July’s growth of 1.8% is a continuation of the recent slowing trend, and well below the recent monthly peak of 3.1% in April, says Goodall.

Still, the average value of New Zealand homes increased by almost $15,000 in August.

The index, shows the average value of New Zealand homes was $937,148 at the end of August, up $14,727 compared to July's average value of $922,421.

Goodall says any reacceleration of house price growth rates, if it eventuates, is likely to be short lived.

“Apart from the prospect of rising mortgage rates and the impact of tighter credit policies, it’s important to factor in the weight of worsening housing affordability.

“As property values rise faster than incomes, the cost of buying a home will simply become out of reach for a growing number of would-be buyers, especially as increasing interest rates start to impact the amount of money people can borrow.

“With property difficult to transact under alert level four restrictions it’s too soon to note any immediate impact on prices from the lockdown to date, however we do have the last lockdown (April 2020) and subsequent price boom to compare to.

“The factors leading to that boom were many, and they’re not all present this time around.

“While the reaction from the Government has so far been supportive, it is unlikely to be stimulatory,” says Goodall.

Quick support

Initial support came quickly with the reintroduction of the wage subsidy scheme and resurgence of support payments for other business costs.

But this leaves a range of other measures, which not only protected the property market from a downturn in prices, but also helped stimulate the market last year.

“Many of these related to mortgage lending with the official cash rate (OCR) being cut from 1% to 0.25%, alongside quantitative easing (government bond buying) from the Reserve Bank which reduced mortgage interest rates and ensured liquidity.

“The Reserve Bank also temporarily removed the loan-to-value ratio (LVR) restrictions, partly to assist the distressed mortgage deferral programme introduced by each of the banks,” says Goodall.

He says in the absence of these additional stimulatory measures CoreLogic does not expect any Covid-induced surge in prices to linger.

In fact, the current LVR settings are tighter than prior to the initial lockdown – 40% deposit requirement for investors – and the Reserve Bank has been clear the next move for the OCR is up.

The RBNZ goes as far as saying that had New Zealand not been plunged into the snap lockdown on the day of its last monetary policy review, then it would have lifted the OCR.

Guidance then, for the RBNZ’s next decision on October 6 is almost certainly an OCR increase of at least 25 basis points, even if parts of the country remain at alert level three or four.

This will maintain a degree of upwards pressure on mortgage rates which historically have worked as a headwind against value growth.

Falling growth

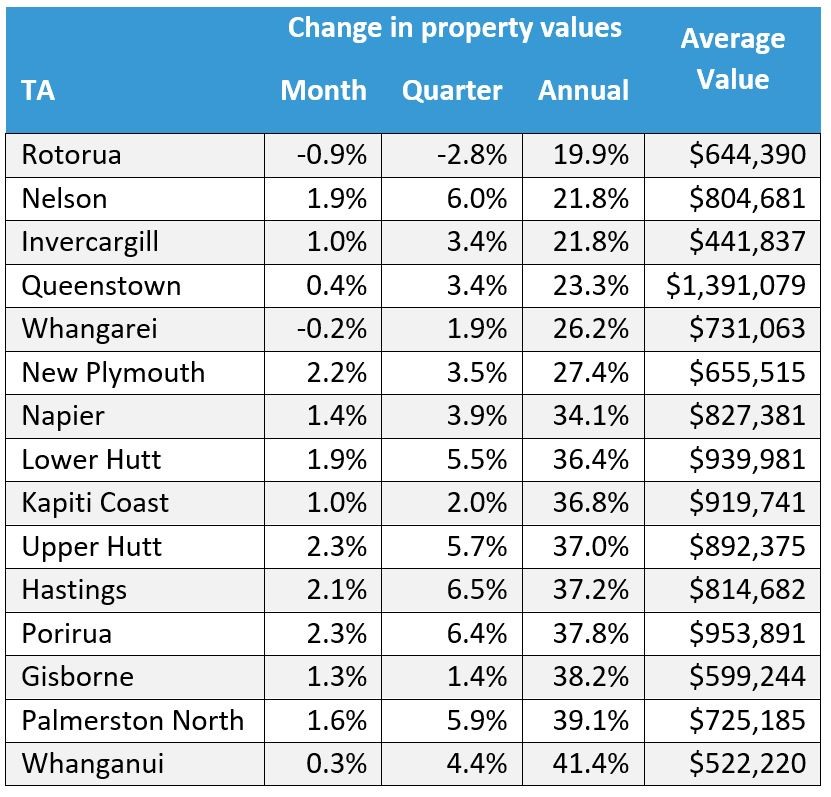

“Areas that have gone through considerable periods of strong growth may be the first to see that lack of affordability start to pinch,” says Goodall.

Rotorua, in particular, has seen a noticeable shift in momentum, with the quarterly rate of change dropping into negative territory (-2.8%) for the first time in more than two years.

“This is especially of interest following a quarterly growth rate as high as 9.7% at the end of May,” says Goodall.

The average value in Rotorua has dropped back below $650,000, but this is well over twice (135% increase) the average value only six years ago ($273,754).

Over the same period the house price to income ratio has increased from 3.6 to 6.5 – a clear illustration of the struggles many buyers will find, trying to get into the market.

Hamilton meanwhile had a sharp drop in the quarterly rate, falling into negative territory (-0.5%) for the first time in more than two years (-0.1% in July 2019).

Affordability is once again a factor, with the average property value almost eight times the average income and the time to save a deposit now exceeding 10 years – showing just how hard it is for new entrants to the market.

Highlights from the CoreLogic HPI for August 2021

National and main centres

Provincial centres by annual growth rate

| « Housing shortage pumps prices | House sales and prices hardly reduced by lockdown » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |